Streamline Your Tax Compliance with our "HSN Code Automation Management" app

Prerequisite:

The organisation needs to be a registered Indian enterprise.

Features:

The app's salient features are as described below:

HSN Category:

The app provides a list of all the HSN categories prevalent under GST regulations of India, from which the user can select the categories applicable to their organization.

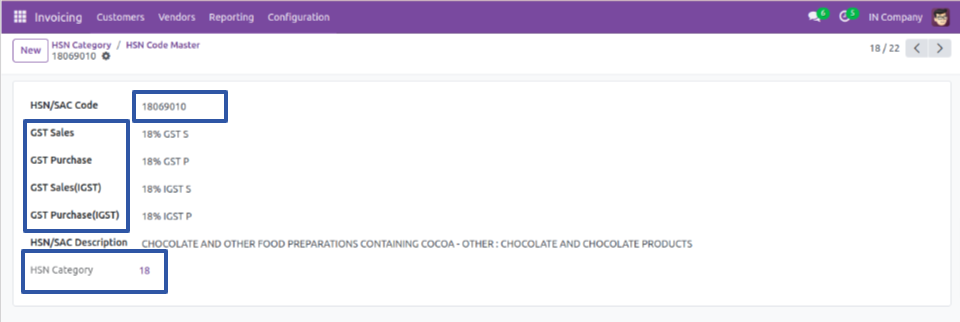

HSN Category Code Master:

When we click on any of the categories above, it shows all the details on the GST rate applicability and the HSN Category Code under which it is applicable.

When we apply this HSN code to our product or service, the applicable GST rate is automatically applied on the orderline when we create a Sales Order or a Purchase Order as shown in the images below:

The most useful feature of this app is it automatically applies the applicable GST rate based on the Product or Service Type and the type of Transactional Flow of goods or service within the country.

This helps the user to avoid reviewing manually the applicable HSN code or calculating the applicable GST rate every time while transacting the goods or services.

Seems interesting? Contact us in helping you assist in managing your GST taxation seamlessly!

Do watch the video explaining the flow of the app on our Youtube channel to have an in-depth overview of the app and we request you to subscribe, like, comment and share our channel to have more such videos on related topics.